How a Responsive Supply Chain helps your brand to survive and thrive – no matter what happens

Efficiency measures and cost-cutting is regarded a quick-fix tonic for ailing Key Performance Indicators, but they have left supply chains in the fashion industry addicted to a cycle of cheap production and unnecessary waste. Without investment in responsive and agile processes, many companies have been unable to adapt and cope with the new reality when markets suddenly shift.

As recent world events have shown, only companies that can adopt more agile processes are able to survive when unpredictable situations (like COVID-19) arise. Is it time to abandon the efficiency mind-set for good, and commit to a better, responsive, way of working?

“Companies must give up the efficiency mind-set, which is counterproductive; be prepared to keep changing networks; and, instead of looking out for their interests alone, take responsibility for the entire chain. This can be challenging for companies because there are no technologies that can do those things; only managers can make them happen.”

A part of the problem

Unpredictable demand is the Achilles’ heel of the Traditional Supply Chain. When faced with surprise ‘market-shock’ scenarios, forecasting becomes useless; all stakeholders in the supply chain scramble to react in a way that preserves their bottom-line, even when this conflicts with the shared goals of the supply chain as a whole.

This traditional attitude prioritises lower costs and efficiency over flexibility and effectiveness; it is unable to cope when conditions suddenly change.

Blaming demand for being unpredictable is like blaming the sunshine for being bright, or the rain for being wet. It is what it is. The problem is rather that forecasting is always inaccurate to some greater or lesser degree, and that the supply chain can get stuck in deeply-ingrained working methods which are counterproductive. According to one study, the average forecast error for fashion items is 55% (this can be a little lower if ordering can be flexibly postponed until a later point).

Instead of trying to predict the unpredictable, we should acknowledge the reality: it is always unpredictable.

We should instead take a stance that is always ready to adapt, and is agile enough to succeed. This is what the Responsive Supply Chain does.

Traditional Supply Chain model vs. Responsive Supply Chain

The Traditional Supply Chain strives to be as efficient as possible, working to add value to the supply chain via tight margins. It focuses on reducing costs in stock procurement, storage, transportation and logistics processes.

In contrast, the Responsive Supply Chain focuses on flexibly meeting the consumer demand, by being sensitive and adaptive. Information is richly shared across all links in the chain, so each participant can effectively regulate their activities in alignment with common goals. Efficiencies are a by-product of putting the customer first. If the consumer demand can be perfectly matched with a symmetrically-responsive supply, then waste is eliminated.

You can’t get more efficient than that.

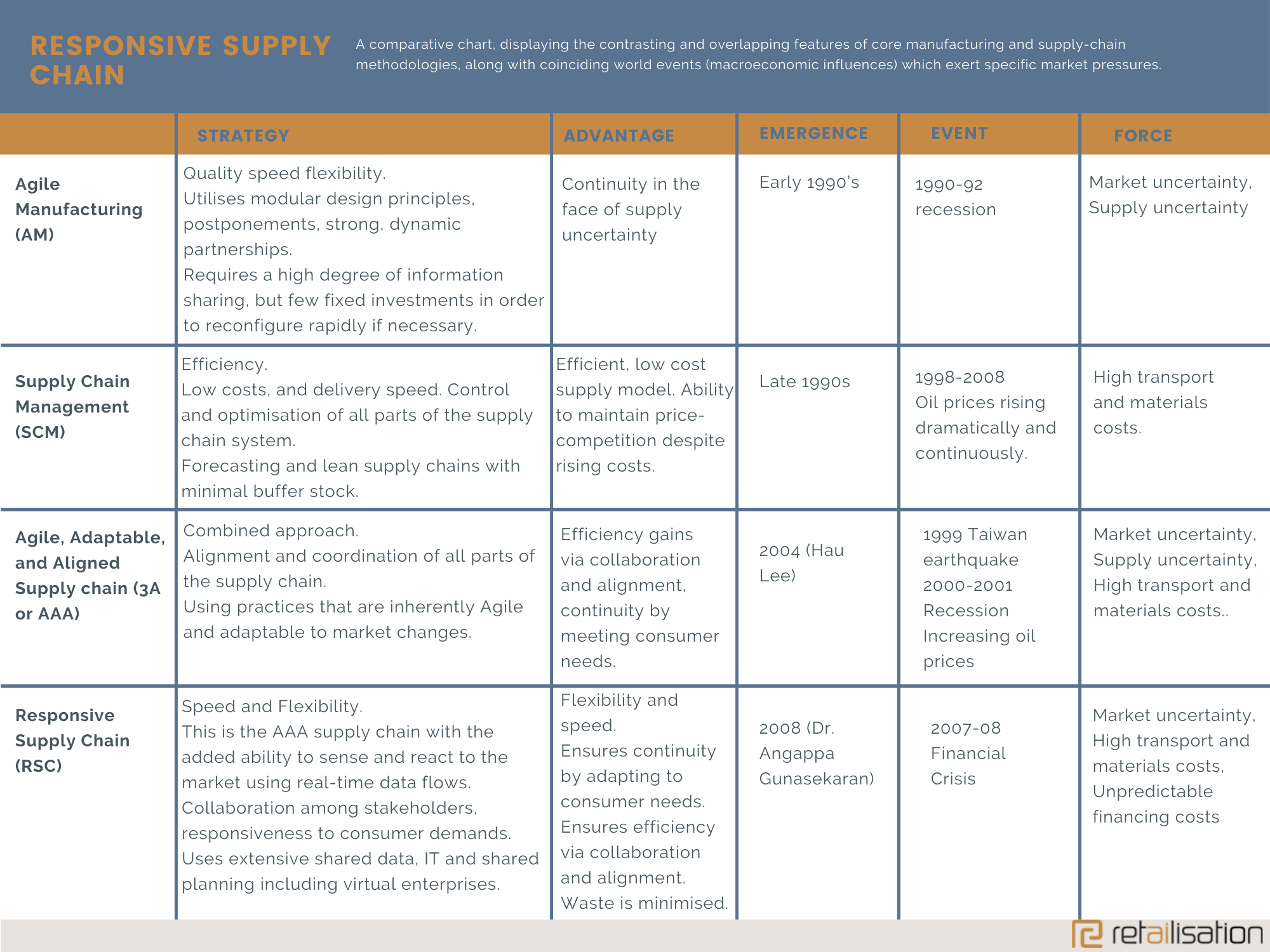

Although we can identify world events that coincide with the emergence of different production and supply concepts, they are clearly not the cause of the methodologies themselves. The situation and market pressure makes them relevant, resonant, and successful under those conditions. Although RSC has always been the better way to do things, it has not been widely recognised or adopted until both the market pressures and the technological ability reached a nexus. That moment is now.

How the Traditional Supply Chain and the Responsive Supply Chain each respond to hypothetical challenges:

Imagine a new product launch

It is like no other product, so there is no data to work from. There is no indication of demand, and preliminary market research offers no insights.

Traditional Supply Chain

Because the TSC relies on forecasting, this is a tough challenge. The rational approach is to issue a conservative forecast, with a pricing strategy that looks to rationalise your brand’s position in the market. Information about the new product needs to be circulated among retailers and consumers early to generate some buzz around the product, and hopefully persuade retailers to place orders. Excessive inventory needs to be minimised, so initial production may not be as cost-efficient as possible. One of two bad scenarios is likely: Understock, resulting in missed sales, or overstock resulting in lost capital via markdowns or waste.

Responsive Supply Chain

Without being able to predict demand, RSC utilises postponement and modular design to delay final decisions on quantities. Fabric or other materials with long lead times can be ordered as soon as initial designs are made, but precise quantities confirmed at a later stage, with MOQ’s and quantity discounts conditionally agreed without commitment. Intensive information flows among all parts of the chain help to regulate the product flow post-launch. In case of high or low post-launch demand, options for replenishments will be explored without committing investment. Reorder-points will be flexibly adjusted to increase or decrease stock levels. The ordering itself can be done in a flexible way, using direct-to-consumer shipping from retail stores or centralised depots. Pre-ordering can be utilised to smooth-out demand and provide an informational basis for adjusting reorder points. Information can flow from retail points directly to the source of the chain, to regulate ongoing production.

How to handle promotions?

Some of the retail outlets you supply decide to boost mid-season sales figures with promotions and special discounts. This may or may not include some of your products, and it may affect sales of your products regardless due to sales synergy or competitive dis/advantage. Your products may see an increase or decrease in sales. You may not even be aware they are running a promotion.

Traditional Supply Chain

Again, the reliance on forecasting is an impediment. You cannot be certain of what products are being promoted, or how it will affect sales of your products. Based on previous years, with similar situations, it may be possible to gauge if there is a likely net percentage effect on sales overall, but it is not possible to determine which products will see this effect. Ultimately, your products will run out of stock unexpectedly, or linger in stores. Either the retailer, or their supplier, is making more money at the expense of the supply chain as a whole.

Responsive Supply Chain

Real-time sales information is fed back into the supply chain using an automated process, with quick-selling items being replenished more frequently, and slower-selling items being delayed until needed. As information is fed back to all stakeholders, all activities along the chain are coordinated using virtual enterprising, automated replenishment, and stock allocation software.

You need to manage inventory

For your e-commerce store, selling via your own website, and a variety of marketplaces.

Traditional Supply Chain

Detailed forecasts based on previous sales are employed for each separate outlet (website, marketplace), and for each product, and then combined into a single, total stock requirement. Orders are placed with suppliers, and this needs to be delivered in a timely way to meet the expected demand accordingly. As stock sells (or is returned), this needs to be updated in a single database, and stock needs to be re-ordered before it runs out. You may discover that your supplier has run out of hot-selling items due to unexpected demand, forcing you to lose SKU’s from your online catalogue. Regular updates to demand forecasts help to reduce overstock a little, but losses are inevitable. Some customers are unhappy that you have sold out of certain items, and when items go missing during delivery it is not possible to replace them due to lean inventory policies.

Responsive Supply Chain

Real-time sales data is fed back up the supply chain from your own systems. This ensures that adequate levels of stock are held in smaller dynamically-adjusted buffers further up the supply chain. Reorder points are dynamically adjusted, and individual item quantities are revised to reflect the actual demand. Delivery and replenishment costs may increase (but these are offset by increased sales), and waste is eliminated.

The effect of ongoing trends in fashion retail

The e-commerce model has upset traditional retail, and changed the way supply chains operate. This is expected to continue, or accelerate. Increased interworking in the e-commerce market is a continuing trend, with deeper integration and information sharing across partners becoming the norm. Drop-shipping is now a common sales model for certain items (usually non-fashion), which benefits all parties due to decreased costs.

The continued growth of marketplace and omni-channel selling means that supply chains are being increasingly consolidated and managed from agile, technologically-enabled warehouses and other partner facilities.

Third-party fulfilment has become an easy option for brands selling via major marketplaces such as Amazon and Zalando, meaning that it isn’t even strictly necessary to hold stock to guarantee availability. All of these trends point towards increased integration of automation, technological solutions, and information flows.

The ‘Amazon effect’ means there is now also a different expectation from the customer.

While e-commerce sales take place outside the physical boundaries of the traditional sales arena, the delivery of the actual goods themselves still needs to be managed in the real-world. This is often best achieved by flexibly utilising assets such as inventory, service locations, and retail points situated at multiple locations.

We can either simply accept the losses from increased stock-outs and redundancy, or we need to find a way to effectively distribute merchandise to the many places where consumers actually buy.

The Corona-effect and the view for the future

During the coronavirus pandemic, many physical stores were forced to close, resulting in unprecedented losses. Stores with an online presence were able to cope in ways that brick-and-mortar only stores could not. According to McKinsey Global Fashion Index analysis, after experiencing a 4% rise in profit in 2019, fashion businesses will see an average decline in profit of 90%.

A rapid switching between sales and supply modes is only possible for those with an agile attitude; who either already sell online, who were adaptive enough to start selling online, or who already had sufficiently agile supply chains that they were able to swiftly move to contain risk. Such a market challenge could never be predicted, but is a reality that must be dealt with in real-time. As disruption from COVID is expected to continue into 2021, it is predicted that sales in the fashion sector will only return to 2019 levels in either Q3 2022 or Q4 2023.

“Brands should secure high-quality and reliable production capacity and make the long-overdue shift to a demand-focused model to operate in this fluid environment.”

The time for responsiveness is right now

A shift in mind-set is necessary to implement the RSC. This includes leaving behind the efficiency mind-set, but also taking a new perspective. It is not wrong to pursue efficiencies, but this task should not come before achieving supply-chain effectiveness. Research has shown that in order for a successful implementation of an agile RSC, top management needs to be totally on-board and supportive of the shift towards a more transparent, collaborative mind-set.

The RSC requires that participants have the same qualities as the AAA model, where instead of focusing on efficiencies only within their own link in the chain (and shifting problems onto other stakeholders), that the supply chain is seen as a collaborative partnership with aligned, common objectives. This means that the shared priority should be to maximise the supply chain throughput – not just the sales efficiency of a single link in the chain.

By fulfilling market demands in an agile way, the supply chain can be both highly responsive, and highly efficient due to reduced waste. The Responsive Supply Chain provides benefits not only in extreme situations, but continues to deliver efficiencies as a by-product of being highly effective.