Why Traditional Retail Performance Indicators Fail

Content

“Tell me how you measure me and I will tell you how I will behave. If you measure me in an illogical way, do not complain about illogical behaviour” – Eliyahu M. Goldratt

When we measure performance, we want to compare the actual output of something to a predefined ideal. A variance from the ideal should trigger a response to improve the system or the process being measured. In other words: to be useful, business metrics need to trigger the right responses, otherwise they lack value.

These business metrics, also called Key Performance Indicators (KPIs), vary between industry sectors and departmental responsibilities. Large organisations with many different departments tend to measure each department separately, with metrics that are considered relevant for their activities.

Traditional retail performance measurement

Traditional performance measurement tends to measure four perspectives of any organisation to determine its general health. These perspectives are:

- Customer perspective (customer satisfaction)

- Internal perspective (company definition of success and excellence)

- Innovation and learning perspective (ability to improve and add value)

- Financial perspective (value to investors)

While the retail performance KPIs that measure these perspectives provide us with a ‘traffic light’ indication of the overall performance of the business, the output doesn’t easily translate into an action – a prerequisite for a useful KPI.

It is even harder when the performance is presented as a ‘Balanced Scorecard’, on which ratings and weightings of the different perspectives result in one final number, and the ‘right’ response becomes a guess or another subject of time-consuming internal debate.

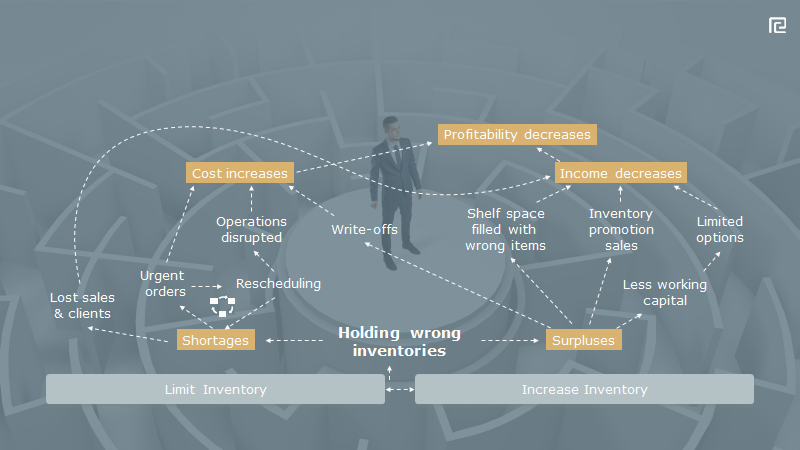

Even actionable KPIs are not useful if they lead to poor decisions. In supply chains, poor decisions are decisions that might well lead to local (departmental) performance optimisation but do nothing to contribute to the performance of the company.

In supply chain companies, disconnected, departmental KPI’s are not always useful, because they tend to measure the output of the link, not the link’s contribution to the throughput of the chain.

For supply chains to be most profitable, they need to be maximally responsive to consumer demand, and each link must behave in a way that benefits the goal of the company. This requires a set of integrated KPIs, which take the big picture into account.

Throughput performance measurement

At Retailisation, we use the Throughput Accounting (TA) method to evaluate supply chain decisions. This method is based on the idea that each organization is a connected system with one goal and that better decisions increase the company’s value. For profit maximizing companies (such as brands and retailers), this goal is to maximise the generation of units of currency (cash), now and in the future.

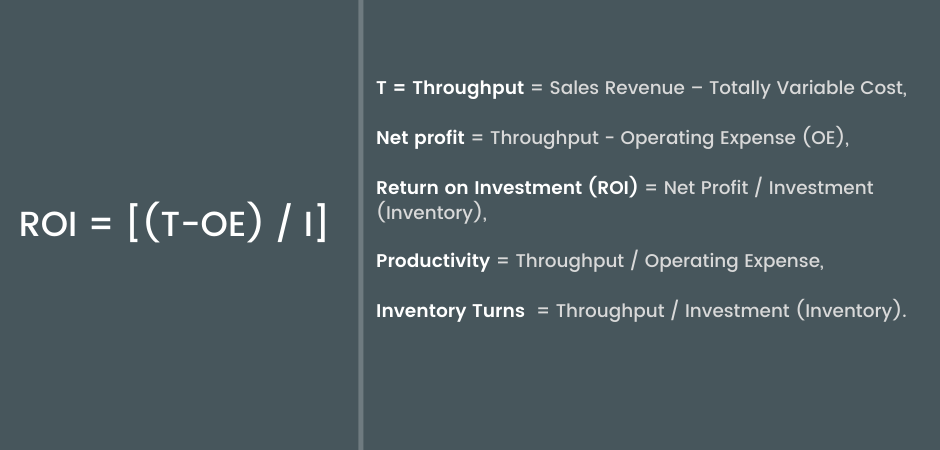

Throughput Accounting differs from traditional Cost Accounting firstly in its recognition of system constraints (anything that blocks throughput) and in that it separates totally variable cost (Cost of Goods Sold) from Operating Expenses to make faster and better decisions. It is based on a simple formula:

All supply chain decisions can now be validated against this simple equation:

Will the proposed decision:

- Increase or Reduce Throughput (Sales – Total Variable Cost)? If yes, by how much?

- Reduce or Increase Investment (Inventory)? If yes, By how much?

- Reduce or Increase Operating Expenses? If yes, by How much?

The answers to these questions determine the overall effect of proposed changes on the company’s performance.

Where traditional performance KPI’s fail?

There are many examples that illustrate how traditional KPIs can cause departments to work against each other to preserve their individual ‘efficiencies’.

One of these is where volume discounts may tempt buyers to increase the order quantity to improve the intake margins, when the average intake margin is considered a KPI. When the sales disappoint, the damage to the business is much greater than the gain in intake margin from volume discounts.

Or the logistics department decides to increase the pack size, or reduce the shipping frequency, when the ‘cost per unit shipped’ is considered a KPI. This requires more investment in stock since lead-times and uncertainty in getting the right item to the right place increases. And the hike in markdowns will further erode company profits. Great for the department – but bad for the company.

In the above examples, changing the buyer’s performance metric from intake margin to gross margin (or Net Profit), and the one for logistics from cost per unit shipped to cost per unit sold (or Productivity), will remove apparent conflicts and lead to more profitable decisions.

Throughput Decision Making

Some years ago, while working with a European retailer, we determined that most ‘lost sales’ occurred on Saturdays. No surprise really, as Saturdays contributed more than 50% to the weekly sales. A ‘crazy’ idea came up – to add a delivery on a Saturday morning before 10am, assuring 100% shelf-availability when the doors open to consumers.

Since shipping on weekends is much more expensive, as weekend wages are higher and local regulations discourage Saturday deliveries via higher taxes on transportation, this suggestion was not immediately embraced, as it would increase operating expenses (OE).

To prove that the additional benefit (T) was greater than the additional operational expense, we tested the idea with the top 40 stores in the retail network and entered the numbers into the formula:

ROI = [(T-OE) / I]

As you may expect, the sales increased more than the operating expenses, making the decision a profitable one. An additional benefit was that average inventory levels went down, so the decision was made to continue this system and extend it to more retail stores.